INVESTMENT HIGHLIGHTS

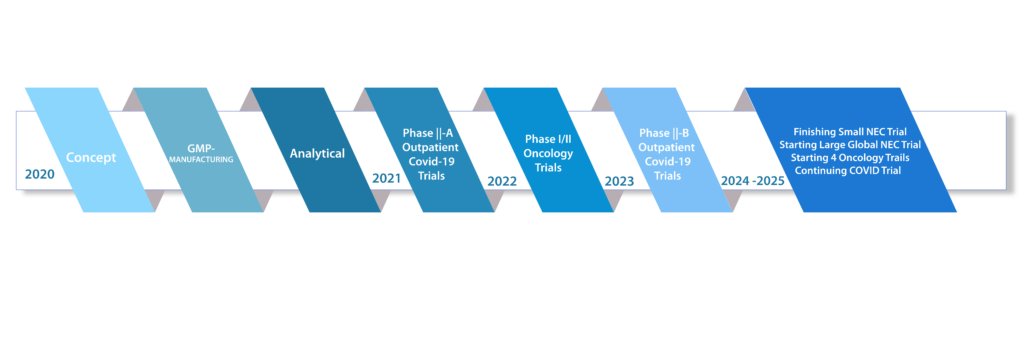

PIPELINE

- NP-101 demonstrated significant immunostimulatory effects in the 2021 clinical study

- Lead asset in development as an adjunct therapy to cancer immunotherapy

- Basket trials of 4 cancer types planned at case western university

TEAM

- Our Advisory Board includes international experts and pharma executives

- Renewed team leading the development and clinical investigations

NOVATEK PHARMACEUTICALS

Novatek Pharmaceuticals is a company with a renowned team leading clinical investigations focused on development of immunomodulatory drugs related to cancers and infectious diseases. Empowering naturally derived immunotherapy that is effective across various cancer types, with the goal of effectively boosting the immune system and T cell population in patients while reducing the adverse effects of disease or cytotoxic therapies.

Our Facts

* Patients had significantly higher lymphocytic blood cell count "effector immune cells" after treatment with NP-101 compared to the placebo group

- Preliminary clinical study results indicate that NP-101 is safe and tolerable.

- Large randomized phase ||-B (308 patients) clinical trial in outpatients COVID-19 is actively accruing.

* 4 oncology trials in the pipeline for 2025

Novatek Pitch Deck Presentation

Other Facts

Black Seeds is the main bioactive component in NP-101 that has a broad spectrum of therapeutic applications

Patent for COVID-19 treatment indication Pending

NP-101 shows promise as an immune-oncology drug across different cancer types

It has been studied as a hepatoprotective, anti-mutagenic, and antitumor therapy with a specific mechanism of action that lends NP-101 as an emerging pharmaceutical

Oncology trial of high-grade neuroendocrine cancers is actively accruing

The global market of oncology drug is over $ 182 B with an expected growth rate of 11.3% in the US alone

Check Out Our Work

FAQ

Most frequent questions and answers

Crowdfunding allows investors to support startups and early-growth companies that they are passionate about. This is different from helping a company raise money on Kickstarter. With Regulation CF Offerings, you aren’t buying products or merchandise. You are buying a piece of a company and helping it grow.

Investors other than accredited investors are limited in the amounts they are allowed to invest in all Regulation Crowdfunding offerings (on this site and elsewhere) over the course of a 12-month period: If either of an investor’s annual income or net worth is less than $107,000, then the investor’s investment limit is $2,200, or 5 percent of the greater of the investor’s annual income or net worth, whichever is greater. If both an investor’s annual income and net worth are $107,000 or higher, then the investor’s limit is 10 percent of the greater of their annual income or net worth, or $107,000 whichever is greater. Accredited investors are not limited in the amount they can invest.

Calculating net worth involves adding up all your assets and subtracting all your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Individuals over 18 years of age can invest.

Investing in startups and small businesses is inherently risky and standard company risk factors such as execution and strategy risk are often magnified at the early stages of a company. In the event that a company goes out of business, your ownership interest could lose all value. Furthermore, private investments in startup companies are illiquid instruments that typically take up to five and seven years (if ever) before an exit via acquisition, IPO, etc.

IPS Systems Inc. is a privately held company, and its shares are not traded on a public stock exchange. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically receive a return on your investment under the following two scenarios: The company gets acquired by another company. The company goes public (makes an initial public offering on the NASDAQ, NYSE, or another exchange). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on the exchange. It can take 5-7 years (or longer) to see a distribution or trading, as it takes years to build companies. In many cases, there will not be any return as a result of business failure. Investments in private placements and start-up investments in particular are speculative and involve a high degree of risk, and those investors who cannot afford to lose their entire investment should not invest in start-ups. Companies seeking startup investments tend to be in earlier stages of development, and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations. Additionally, investors on Regulation CF offerings will receive securities that are subject to holding period requirements. The most sensible investment strategy for start-up investing may include a balanced portfolio of different start-ups. Start-ups should only be part of your overall investment portfolio. Investments in startups are highly illiquid and those investors who cannot hold an investment for the long term (at least 5-7 years) should not invest.

Shares sold via Regulation Crowdfunding offerings have a one-year lock up period before those shares can be sold under certain conditions.

If a company does not reach their minimum funding goal, all funds will be returned to the investors after the closing of their offering.

All available financial information can be found on the offering pages for the company’s Regulation Crowdfunding offering.

You may cancel your investment at any time, for any reason until 48 hours prior to a closing occurring. If you have already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email [email protected]